Loan Holders Get Bit By Bit Ease From Biden Administration

The Biden administration is thinking about extending a pandemic freeze on Americans’ student-loan repayments beyond its scheduled expiration in September and turning to piecemeal measures to lower their student-debt bills.

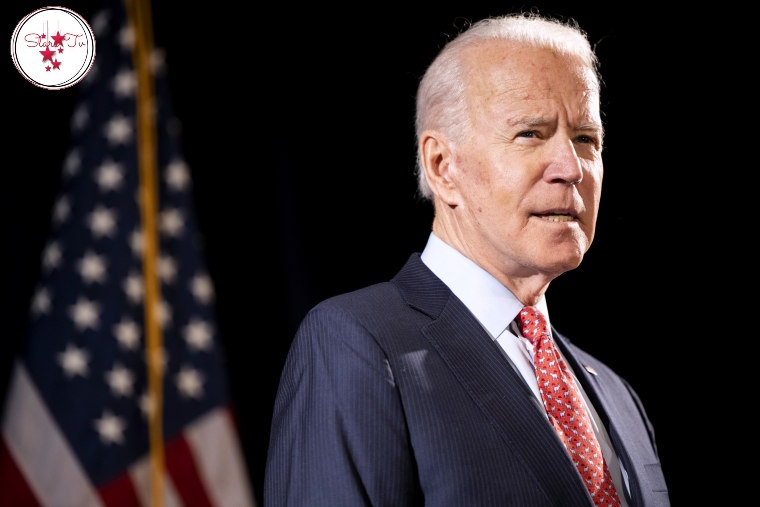

Five months into his term, President Biden has resisted calls from fellow Democrats and activists to cancel most of America’s $1.6 trillion in federal student-loan debt in one swoop through an executive action. Congress additionally appears unlikely to make it happen because Democrats lack the Republican support they would need to pass such a measure.

Yet many Americans efficaciously are seeing their debt bills decreased via policy changes that started under the Trump administration, which froze student-loan repayments when the pandemic started unfolding in March 2020. The move, which the Biden administration extended through September, has in effect forgiven tens of billions of dollars in student debt that families otherwise would have paid, mostly by waiving interest charges.

Mr. Biden’s education secretary, Miguel Cardona, told a congressional panel last month that the administration is thinking about extending the payment freeze beyond September. Asked for comment on that possibility, an administration official stated Mr. Biden “continues to seem to be into what debt-relief actions can be taken administratively.” The official restated Mr. Biden’s desire for Congress to pass a law to forgive $10,000 in student debt for every federal borrower. Administration attorneys are studying whether the president has the authority to cancel debt thru executive action, the official said.

Last month, the Education Department canceled $500 million in student debt owed by thousands of former students of the defunct ITT Technical Institute, which federal regulators have accused of financial mismanagement and deceptive recruiting tactics. The department has stated it would move later this year to tweak federal rules to allow more aggrieved debtors who attended other for-profit schools to have their debt forgiven.

.jpeg)